GaN/SiC Power Electronics: The Quiet Revolution Behind Ultra-Fast Charging

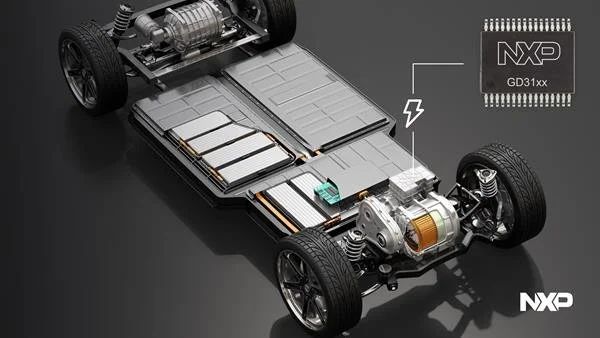

Companies like NXP develop high-voltage (HV) isolated gate drivers to work with GaN/SiC power devices.

Credit: NXP

Why wide-bandgap devices are the bottleneck—and unlock—for EV hubs

Fast-charging hubs and high-power converters live or die on losses, thermal headroom and reliability. Wide-bandgap (WBG) semiconductors—silicon carbide (SiC) and gallium nitride (GaN)—promise higher voltage, faster switching and smaller, cooler systems. The transition isn’t marketing; it’s materials science. SiC has already become the default in many high-voltage stages, while GaN’s lateral device architectures have historically capped voltage—driving interest in vertical GaN for >1.2 kV classes as vendors pursue EV infrastructure and grid-scale applications. The US Department of Energy’s WBG strategic framing captures this migration and the technical hurdles that remain.

At the site level, WBG shows up as higher-efficiency rectifiers/inverters, smaller magnetics, and more compact thermal systems—critical when retrofitting constrained urban parcels. But integration matters: EMI, gate-drive design, fault detection and thermal coupling can erase theoretical gains if executed poorly. Reliability narratives hinge on qualification data, field MTBFs, and derating policies across temperature and load cycles. For multi-vendor sites, module interoperability and serviceability push buyers toward suppliers who publish reference designs and provide robust diagnostics.

Commercial traction often follows a solution sale: not a single device, but a site kit—power modules plus thermal, EMI filters, cabinet design, and a maintenance plan tied to measured conditions. Charge-point operators, fleets and utilities care about uptime SLAs, grid-code compliance and forward-compatible architectures (e.g., grid-forming inverters). Suppliers that can quantify owner economics—spend less on switchgear and cooling, install faster, service easier—win procurement even when device costs are higher. Publicly available market and research briefs back up the direction of travel and help non-specialist stakeholders justify WBG adoption to boards and lenders.

The punchline: the “charger of the future” is mostly a power-electronics product. Put WBG devices at the centre of the design and wrap them in serviceable, standards-compliant cabinets, and you unlock both capex and opex advantages. Ignore the integration details, and you inherit a maintenance problem at megawatt scale.