Smallsat Platforms Are Configurable Products—and Gateways to ARR

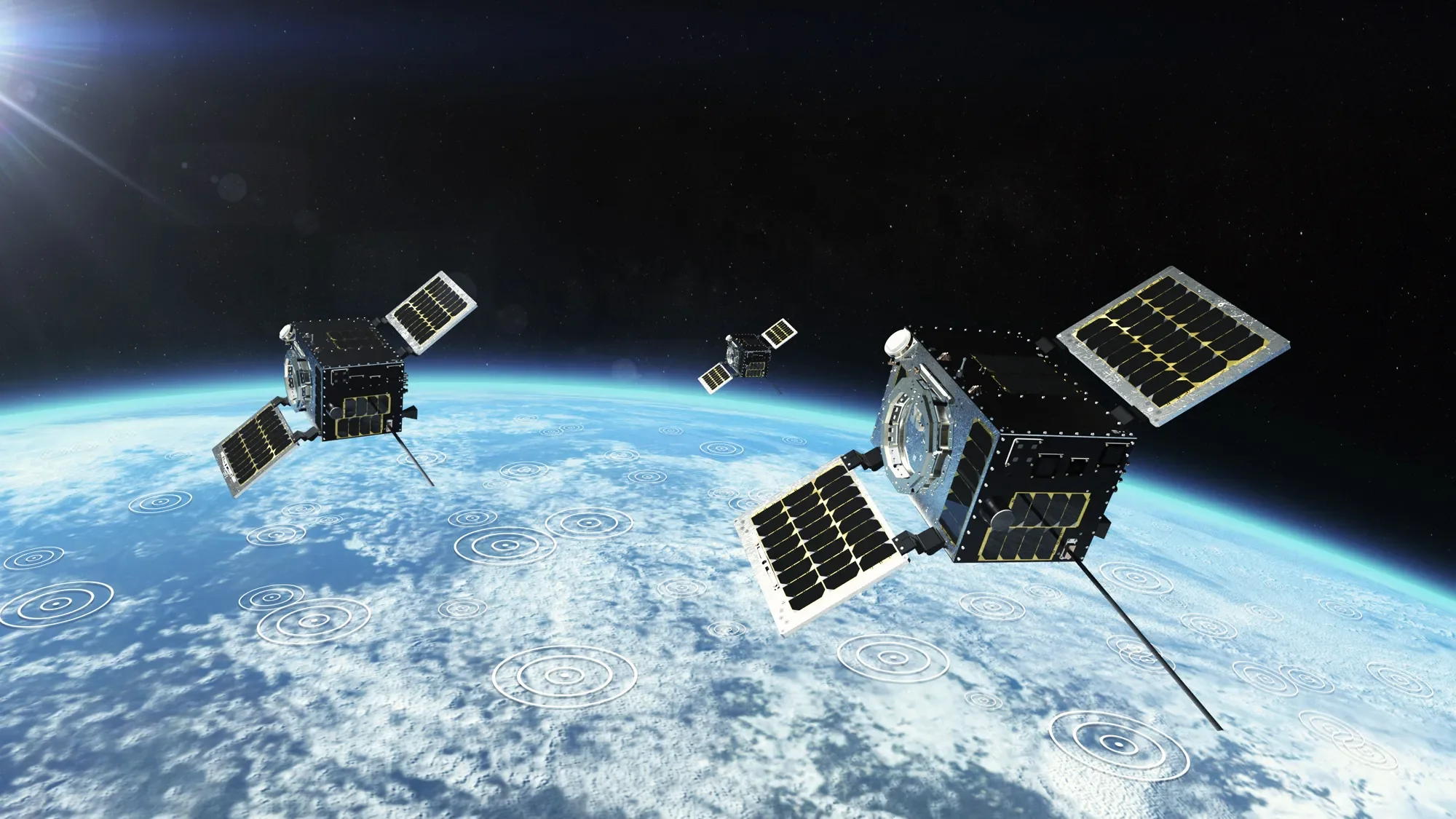

As part of a commercial constellation, HawkEye 360 small satellites (pictured) are designed to detect, geolocate, and characterise radio frequency signals from space.

Credit: Hawkeye 360

From bespoke spacecraft to standardised buses powering data and services

Smallsats have crossed the line from artisanal projects to configurable products. The shift began with standardised buses (e.g., CubeSat form factors) and has accelerated with software-defined radios, modular payload bays and common ground software. Startups now assemble missions from catalogues: select a bus, add a sensor, integrate a flight computer, then deploy via a rideshare or dedicated small launcher. This productisation compresses non-recurring engineering, shortens lead times and makes performance more predictable—exactly what enterprise buyers need to budget and scale.

The real commercial unlock is not the satellite; it’s the service layer. Once operators can put up capacity in repeatable increments, they can sell what customers actually value—tasking, latency, revisit, and analytics—on subscription. In Clayton Christensen’s terms, Smallsats enter as “good enough” for overlooked jobs-to-be-done (university missions, niche monitoring), then iterate quickly until they satisfy mainstream requirements. Each additional satellite tightens revisit, improves model accuracy and increases the utility of the API, creating a flywheel from deployed assets to recurring software revenues.

This is the Silicon Valley ethos applied in orbit: vertical integration where it speeds iteration, automation across the ground segment, and feedback loops that turn raw pixels into decision-grade signals. As chronicled by authors such as Ashlee Vance, the companies that win are those that treat spacecraft as updatable nodes in a data network, not one-off triumphs of engineering.

Commercial Takeaways

Founders should design for catalogue-ready configurability from day one—standard electrical/mechanical interfaces, containerised flight and ground software, and a billing model that assumes usage-based or tiered subscriptions for data and analytics. Investors should underwrite the transition from hardware revenue to ARR by tracking cohort retention on data products, the ratio of capacity added to bookings, and gross margin expansion as the analytics mix rises. Enterprise buyers should de-risk adoption with API pilots tied to specific KPIs (yield, downtime, loss ratios), then scale via contracts indexed to service levels (revisit, latency) rather than satellite counts. Policy-makers should prefer outcome-based procurement that buys services—tasking, comms, analytics—allowing smaller providers to compete on performance while compounding learning through higher cadence deployments.