Defense Goes Proliferated: SDA Tranche-2, Lasercom Reality, and Openings for Dual-Use Suppliers

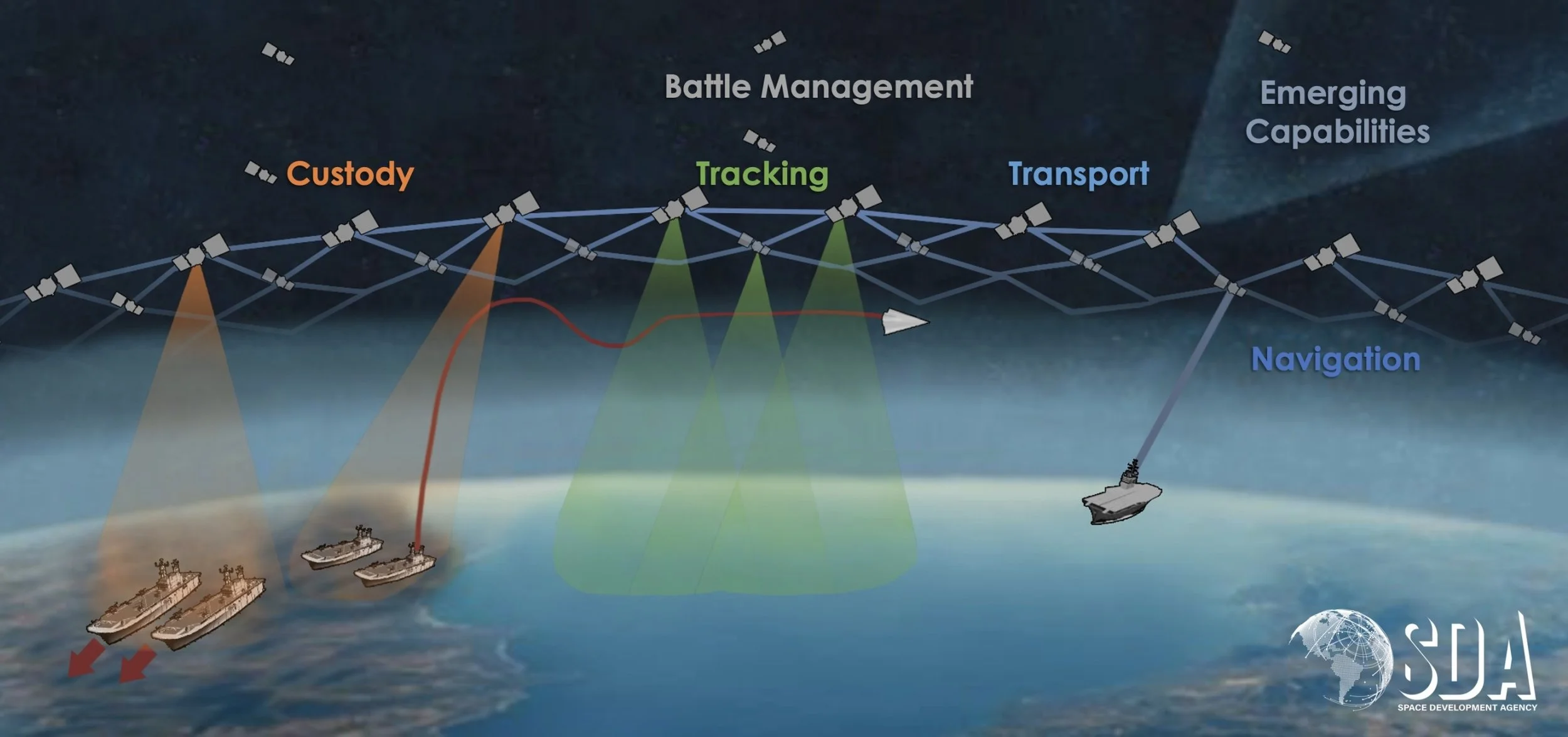

Tranch 0-3 represents the full scale of the Space Development Agency’s multi-year project.

Credit: SDA

The two-year spiral meets the hard edges of optical links—and that’s where nimble vendors fit

The Space Development Agency (SDA) has pushed U.S. defence space from monoliths to rapid spirals. On 7th March, it moved to recompete a tranche of its Transport Layer “Gamma” satellites—visible proof that the procurement flywheel keeps turning even as subsystems evolve. For commercial suppliers, the practical question is where the hurdles really are and how to enter the programme without overreaching.

Laser crosslinks sit at the centre of that conversation. In February 2025, the U.S. Government Accountability Office (GAO) published a focused assessment of SDA’s optical communications push. The gist wasn’t “stop” but “sequence”: GAO urged clearer linkage between development stages and on-orbit demonstration, cautioning against overcommitting before proving integration at scale. Coverage in the trade press framed it as a tempo-vs-maturity tension inherent to SDA’s two-year cycle. For vendors, that translates into opportunities to test, assure, and interoperate.

A commercial reading is straightforward. The Transport Layer is a platform play; its value compounds when each cohort adds reliable capacity and better behaviour under stress. Optical terminals, pointing and acquisition software, encryption keying, and ground test tooling that can keep pace with frequent builds are scarce. Firms that can demonstrate repeatable performance across environmental extremes, clean interfaces to multiple terminal types, and robust telemetry/QA pipelines are more likely to be pulled into flight programmes—especially when a portion of Tranche-2 capacity is being re-bid to maintain competition and resilience.

Go-to-market, expressed in a newsy rather than prescriptive tone, looks like careful sequencing. Teams are showing heritage on commercial LEO first, then migrating the same hardware/software stack into SDA’s environment with incremental security hardening. Integrators want suppliers who respect the spiral: ship something that works now, prove it in representative loops (thermal, radiation, vibration, jitter), and keep roadmaps aligned to the next build window rather than a notional “block upgrade.” Vendors that share realistic lab-to-orbit verification plans, invest in interoperability testing against more than one terminal design, and publish acceptance artefacts the government can reuse are the ones getting meetings—because they reduce schedule risk without slowing cadence.

Downstream, the dual-use side matters. A supplier that can support both defence LEO and commercial backbones creates redundancy for the national architecture while smoothing its own revenue volatility. Expect more activity in emulation ranges, calibration sources, cyber instrumentation, and on-orbit validation services that bridge the gap between paper compliance and operational proof. In a world where “good enough now” often beats “perfect late,” the firms that productise testability—rather than just performance—will capture durable share in proliferated space.