QKD and Beyond: Commercial Models for Space-Based Quantum Links

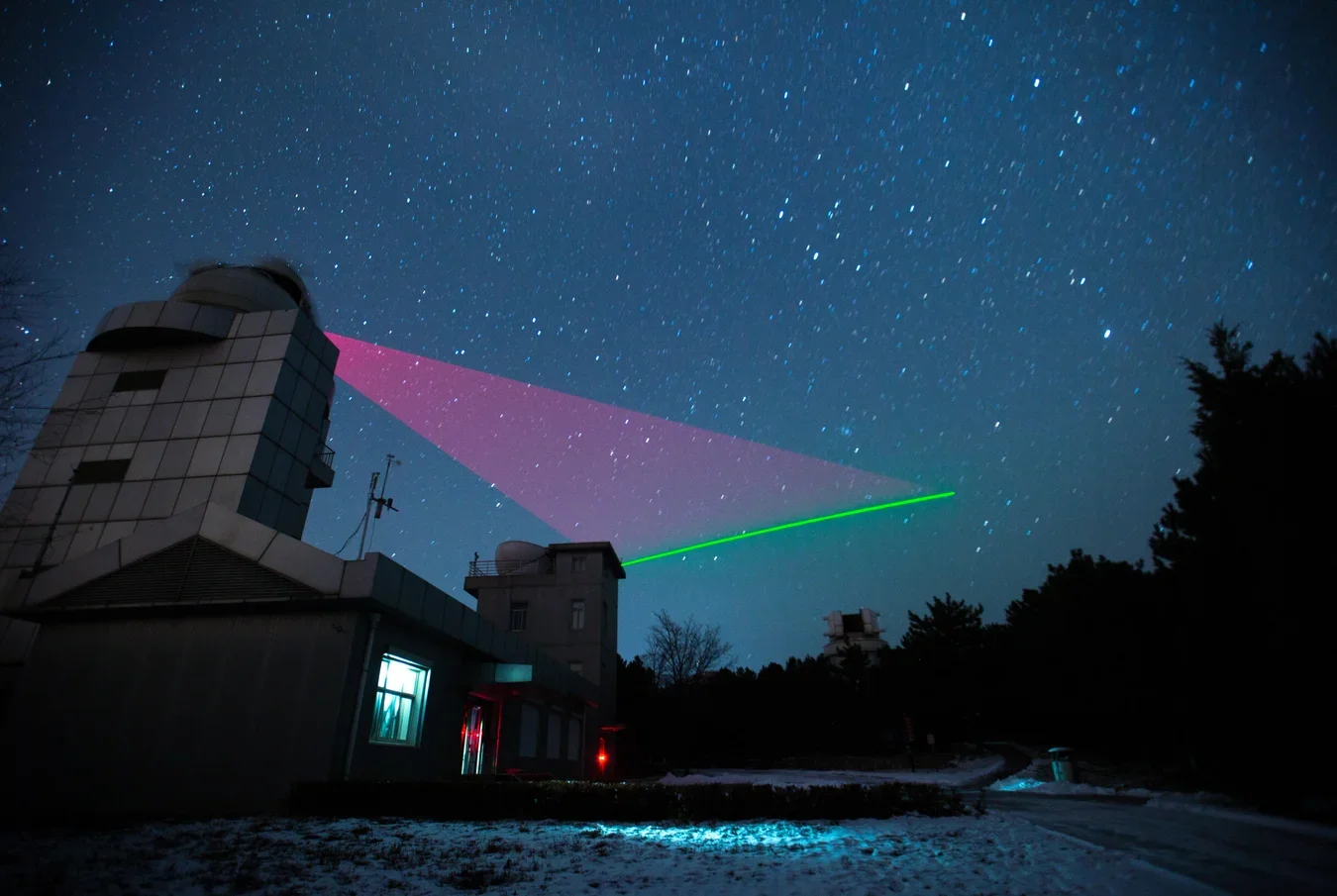

Figure 1. The quantum communication ground station in Xinglong, China first established a satellite-to-earth link with the quantum satellite "Micius" in 2016.

Credit: Jin Liwang on Alamy

From demonstrators to paying services with SLAs

Space-based quantum links have moved from lab drama to something buyers can plan around. China’s Micius satellite proved that you can use quantum physics to share encryption keys across continents—showing satellite-to-ground quantum key distribution (QKD) and even intercontinental, quantum-secured calls. In plain terms, QKD lets two endpoints generate matching random keys while revealing any eavesdropping; those keys then feed normal encryption. Europe has since laid out a sovereign route via EuroQCI, with ESA’s Eagle-1 mission targeted for launch in late 2025 to early 2026 to validate services before scaling.

Figure 1 shows China’s Xinglong quantum ground station linking with the Micius satellite—the telescopes, tracking optics and secure key-handover equipment behind the first space-QKD demonstrations. It provides the visual bridge from proof to service: the same class of terminals EuroQCI’s Eagle-1 plans to use to deliver fresh keys into existing security stacks—key-management systems (KMS) and hardware security modules (HSMs)—with clear service-level agreements (SLAs).

What A Space Quantum Link Actually Sells

A satellite QKD service does not carry your emails or market data. It delivers fresh encryption keys to your ground sites, securely and repeatedly. Those keys are then loaded into your existing cryptography—think IPsec, MACsec or TLS—via the same enterprise hardware you already trust. You will also see QRNG on price sheets: that’s quantum random number generation, a source of high-quality randomness that can strengthen key generation or seed hardware security modules. In practice, buyers should ask how keys flow into their KMS and HSMs, and insist on documented interfaces so the service is auditable and repeatable. The ETSI QKD-004 specifications exist for exactly this integration task.

Two Architectures, Two Sales Stories

Vendors will talk about trusted-node and entanglement-based links:

Trusted-node means keys are generated between each ground station and the satellite, and relayed via satellite equipment. Those satellite nodes must therefore be trusted by the operator and, by extension, the customer. Think of it as a secure relay model.

Entanglement-based aims to distribute correlations directly between two distant ground sites using pairs of linked photons; in its ideal form, the satellite doesn’t need to be trusted because it never “sees” the whole key. Micius experiments showed the foundations of this approach at continental scale.

EuroQCI’s public materials and ESA’s Eagle-1 pages describe a stepwise path: validate space QKD end-to-end, prove ground integration, then expand toward a constellation that meshes with European fibre networks. If you align your offer to those official roadmaps, procurement friction drops because your plan matches what ministries and regulators already expect.

Packaging It Like Telecom

The tone that lands with CISOs and network teams is pragmatic, not utopian. Successful offers look like telecom services:

Service Definition: Satellite-assisted QKD (and optional QRNG) delivered to named sites. Keys are pushed into customer KMS/HSMs over documented APIs with event logs. Reference ETSI QKD-004 in the integration kit.

SLA Metrics: Availability windows (satellite passes), key rate targets per pass and per day, latency for key delivery, and recovery procedures if a pass is missed.

Trust Model Disclosure: State whether links are trusted-node or entanglement-based, how satellite and ground equipment are hardened, and how tamper events are detected and reported.

Compliance Fit: Map the service to sector rules (finance, national infrastructure) and to EuroQCI architecture where relevant, so buyers can show internal auditors a known template.

Who Buys First—and Why

Early adopters are the networks with the most to lose: sovereign and defence users, regulated finance, and inter-data-centre operators carrying high-value flows. They are already comfortable with leased lines, HSM fleets and change management; adding a satellite key source is an extension of current practice. Public communications from ESA and the European Commission consistently frame EuroQCI as an overlay that enhances conventional infrastructure rather than replaces it, which is why integration and auditability matter as much as physics.

How This Coexists With Post-Quantum Cryptography

It’s important to be clear about scope. National guidance in the UK stresses that QKD does not provide authentication and therefore cannot stand alone; it must be paired with conventional cryptographic mechanisms. In parallel, governments are telling operators to migrate to post-quantum cryptography (PQC)—new, classical algorithms that resist future quantum computers—on a defined timetable. Read this as a both/and: QKD (and QRNG) can harden key exchange in specific links; PQC upgrades protect the whole estate. They’re complementary, not competing mandates.

What To Ask Vendors Before You Sign

Integration Evidence. Show a working path into our KMS/HSM stack, with ETSI QKD-004 compliance and a support matrix for major vendors. Provide a test harness so our teams can replay events.

Key-Rate Realism. Quote key delivery per satellite pass and per day, not theoretical maxima, and disclose how weather, pointing and background light affect rates. Anchor claims to in-orbit data or programme documents (e.g., Eagle-1 validation plans).

Trust Model & Monitoring. If the offer is trusted-node, what protections and audits exist on the satellite segment? If entanglement-based, how are losses and errors handled?

Operations Playbook. Provide change control, tamper response, and end-to-end logging so security teams can audit who received which keys, when.

Interoperability & Roadmap. Explain how keys interwork with terrestrial fibre QKD where present, and how your roadmap tracks EuroQCI phases.

The Near-Term Roadmap

On the European track, Eagle-1 is slated to launch in late 2025 to early 2026, followed by up to three years of in-orbit validation supported by the European Commission. Expect early services to focus on a handful of national sites with clear operational value, then expand as procedures and tooling settle. Micius remains the public proof that space can seed keys over very long distances; Europe’s task is to turn that capability into a service with SLAs, integration kits and billing that an operator can run at scale.

Bottom Line

Sell keys, not revolutions. The credible path for space-based quantum links is a telecom-style service that delivers fresh keys into existing security stacks, backed by clear SLAs, trust-model transparency and audited integrations. Align to EuroQCI and Eagle-1 plans, acknowledge that PQC migration proceeds in parallel, and you have something buyers can procure today—and scale tomorrow.